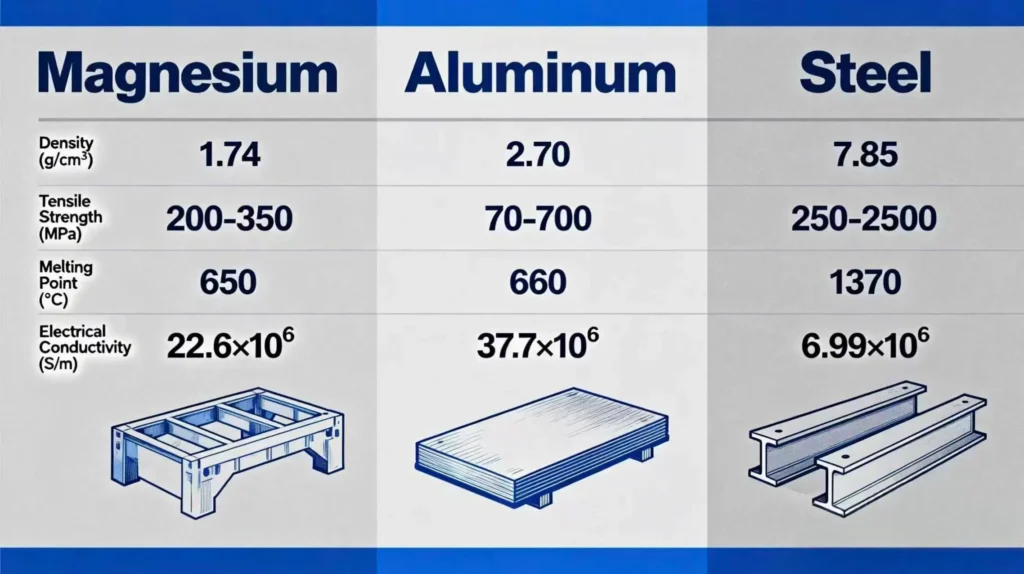

For automotive engineers and OEM strategists, the path to achieving stringent emission targets and extending electric vehicle (EV) range is unequivocally linked to weight reduction, directly fueling the growth of the automotive magnesium die casting market. While aluminum has been the go-to material, a strategic shift is underway within this market. Magnesium, with its superior strength-to-weight ratio… is transitioning from a niche application to a mainstream automotive material. This shift is propelled by a confluence of economic, technological, and regulatory drivers that are fundamentally reshaping the automotive magnesium die casting market. This article provides a data-driven analysis of the key trends and strategic considerations for 2026 and beyond.

Market Size and Growth Trajectory

The automotive magnesium die casting market is on a robust growth path. Concrete data underscores this acceleration. For instance, the UK market, a significant regional segment, is expected to grow from USD 34.67 million in 2024 to USD 58.10 million by 2029, at an impressive Compound Annual Growth Rate (CAGR) of 8.98%. In North America, the market is projected to register a CAGR of more than 6% during the forecast period, driven by the presence of leading automobile manufacturers and stringent CAFÉ standards. The global automotive magnesium die casting market exhibits varied growth dynamics across regions. The table below summarizes key regional forecasts for this expanding market:

| Region | 2025 Market Size (Base) | 2030 Market Size (Forecast) | CAGR (2025-2030) | Primary Growth Drivers |

|---|---|---|---|---|

| Global Market | USD 4.42 Billion1 | USD 7.81 Billion1 | 9.65%1 | Global emission regulations and lightweighting demands for Electric Vehicles (EVs) to extend battery range2. |

| Asia-Pacific (Leading Region) | (Est. >40% of global share)1 | - | - | High automotive production (China accounts for over 60% of regional market3), growing middle class, and supportive government policies for EVs and new energy vehicles1. |

| China (Dominant Country) | USD 6.39 Billion (36.49% of global)4 | USD 13.91 Billion (41.43% of global)4 | - | Policy support, rapid NEV industry growth, and a mature local supply chain. China produces over 85% of the world's primary magnesium, enabling cost-competitive solutions5. |

| North America | - | - | >6% (2024-2029)6 | Stringent CAFÉ standards, presence of major automakers, and policies to improve technical workforce (OSHA, NADCA)7. |

| Europe | - | USD 2 Billion (by 2033)8 | 6.5% (2026-2033)8 | Strict carbon emission standards (e.g., Euro 7), leadership in premium and luxury vehicle manufacturing, and a focus on sustainability1. |

References:

[1] Mordor Intelligence: Magnesium Die Casting Market - Analysis, Growth, Trends, Forecasts (2025-2030)

[2] EPA: Revised 2023 and Later Model Year Light-Duty Vehicle Greenhouse Gas Emissions Standards

[3] IBISWorld: Die-Casting in China - Market Research Report

[4] IMARC Group: Magnesium Die Casting Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2024-2032

[5] USGS: Mineral Commodity Summaries 2023 - Magnesium

[6] MarketsandMarkets: Automotive Lightweight Material Market by Material (Metals, Composites, Plastics), Application (Body in White, Chassis, Powertrain), Vehicle Type (ICE, Electric, Hybrid), and Region - Global Forecast to 2029

[7] OSHA: Occupational Safety and Health Administration; NADCA: North American Die Casting Association

[8] Global Market Insights: Magnesium Die Casting Market Size By Product, By Application, Industry Analysis Report, Regional Outlook, Growth Potential, Price Trends, Competitive Market Share & Forecast, 2024 – 2032

The Market at an Inflection Point: Key Drivers for 2026

The automotive magnesium die casting market is experiencing accelerated growth, moving beyond traditional steering wheel frames. According to a comprehensive analysis by Mordor Intelligence, the market is projected to witness a significant compound annual growth rate (CAGR) through the forecast period, fueled by the relentless pursuit of vehicle lightweighting. This growth is underpinned by three core drivers.

The Economic Driver: A Favorable Cost Paradigm

For the automotive magnesium die casting market, a pivotal change has been the stabilization of magnesium pricing. Expert Market Research and other analysts note that the price volatility of magnesium has reduced, making long-term planning more feasible for OEMs. When considering the cost per volume and the greater lightness achieved, magnesium often presents a compelling total cost-in-use argument compared to aluminum for specific applications, especially as production volumes scale.

The Technological Driver: Overcoming Historical Barriers

The perception of magnesium as prone to corrosion and difficult to process is outdated. Advances in high-purity alloy development (e.g., AE44, AM60) and advanced surface treatment technologies like micro-arc oxidation have drastically improved corrosion resistance. Furthermore, the adoption of vacuum high-pressure die casting minimizes porosity, allowing for the production of structural, safety-critical components that meet rigorous automotive standards.

The Demand Driver: Electrification and Regulatory Pressure

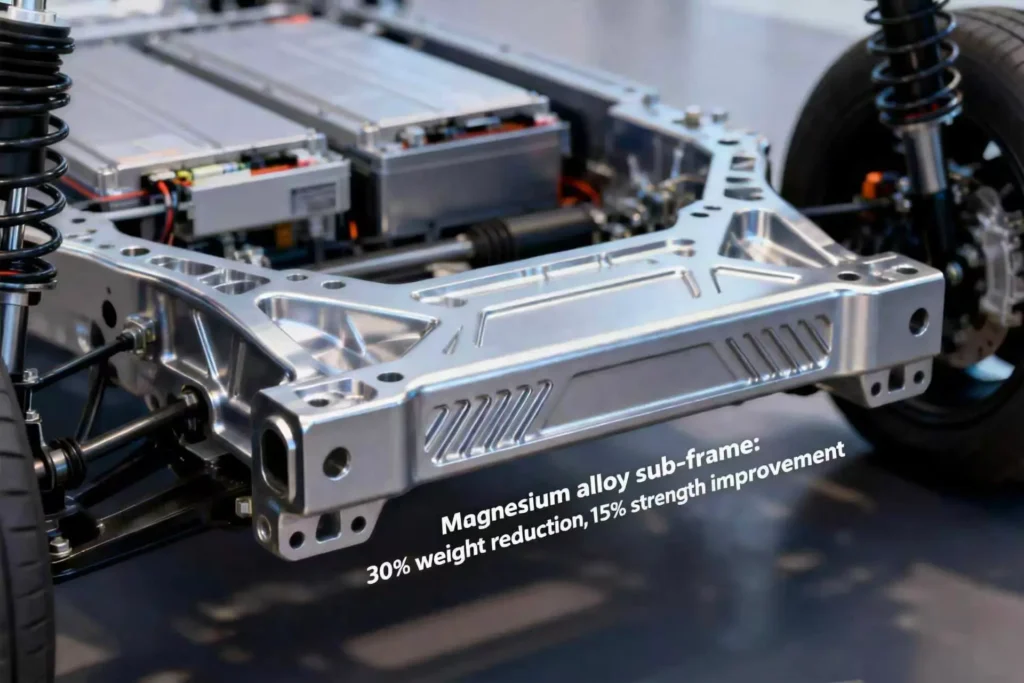

The single largest demand-side driver for the automotive magnesium die casting market is the explosive growth of the electric vehicle sector. Every kilogram saved in an EV directly translates to extended range or the ability to use a smaller, less costly battery pack. Straits Research highlights the increasing use of magnesium in E-mobility solutions as a key trend. Simultaneously, global emissions regulations, such as the Euro 7 standards and China’s China VI, continue to tighten, making lightweighting a compliance necessity rather than a luxury.

Regional Market Dynamics and Competitive Landscape

The automotive magnesium die casting market is fragmented, with key players competing on innovation and global expansion. Major companies include Meridian Lightweight Technologies, Georg Fischer AG, Gibbs Die Casting, Shiloh Industries, and Pace Industries. Competition is intensifying as these players focus on R&D to develop better production processes and alloys, and expand their global reach through mergers and acquisitions.

Advanced Applications: Where Magnesium is Making Inroads

A defining trend in the automotive magnesium die casting market is the rapid expansion of its application landscape, moving beyond traditional interior components to critical powertrain and structural parts.

Electric Vehicle Core Components

Battery Enclosures & Trays: Magnesium’s excellent shielding properties and lightweight nature make it ideal for protecting EV battery packs.

E-Drive/Hybrid Transmissions: Housings for electric motors and gearboxes benefit from magnesium’s weight savings and good damping characteristics.

Power Electronics Housing: Efficient thermal management is crucial, and magnesium housings contribute to system-level weight reduction.

Structural and Body-in-White Applications

The industry is moving towards larger, more integrated components. Front-end carriers, inner door panels, and even pilot projects for mega-cast rear subframes are being explored. The semi-solid die casting process (often called thixomolding) is particularly suited for these complex, thin-walled structural parts, offering superior dimensional stability and mechanical properties.

Navigating Challenges and the Competitive Landscape

Despite the optimism, the automotive magnesium die casting market presents challenges that influence supplier selection. A primary consideration is the concentrated raw material supply, with much of the world’s primary magnesium production located in specific geographic regions, necessitating robust supply chain planning for global OEMs.

- Increased Adoption of Advanced Processes: Vacuum and semi-solid die casting will become standard for high-integrity structural parts.

- Design for Sustainability: The focus will increase on the recyclability of magnesium alloys and on developing closed-loop recycling systems.

- Material Hybridization: Intelligent design combining magnesium, aluminum, and advanced composites to optimize performance and cost.

Conclusion: A Material Whose Time Has Come

The strategic takeaway for automotive OEMs and Tier-1 suppliers is clear: integrating magnesium die casting into the advanced materials portfolio is critical for achieving next-generation lightweighting and electrification goals, making mastery of the automotive magnesium die casting market a competitive imperative. This market is poised for sustained growth, driven by irrefutable economic, technological, and regulatory forces. Success in 2026 and beyond requires partnering with die casters that possess not only the technical capability but also the collaborative engineering mindset to co-develop solutions from the design phase, while navigating the unique dynamics of the global automotive magnesium die casting market.